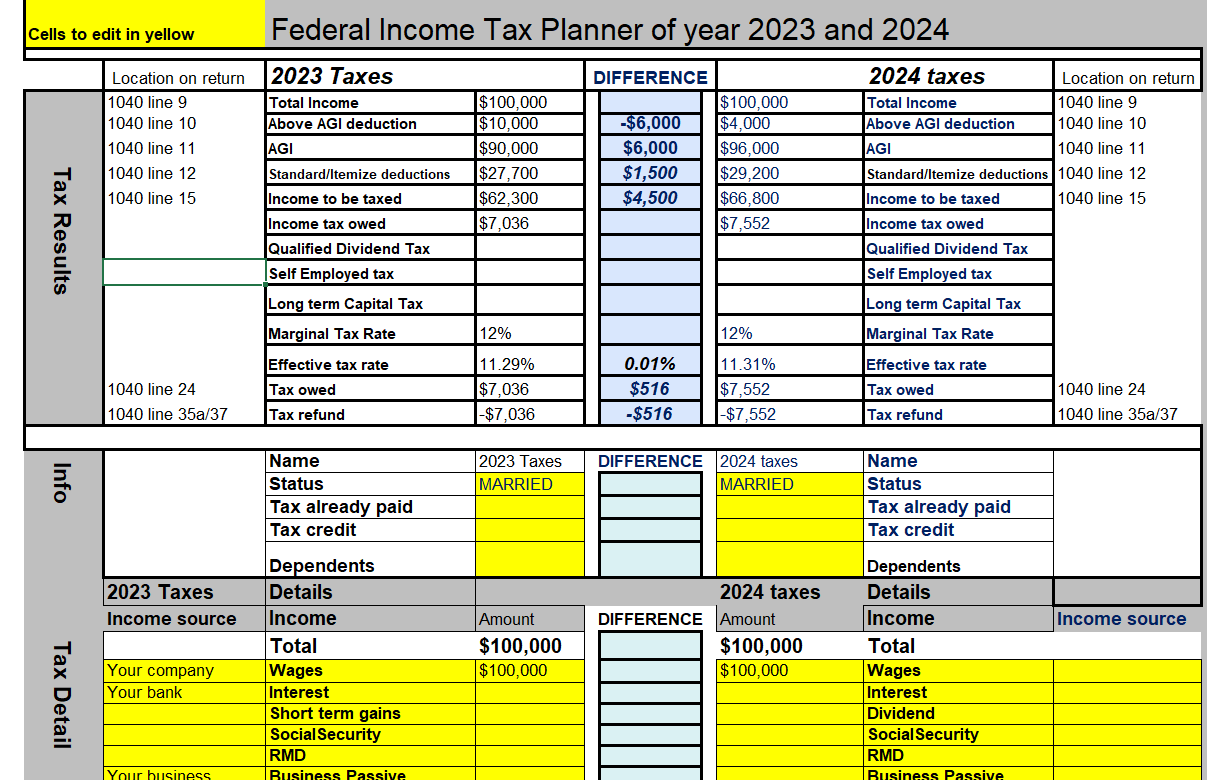

Our story on our tax calculation spreadsheet.

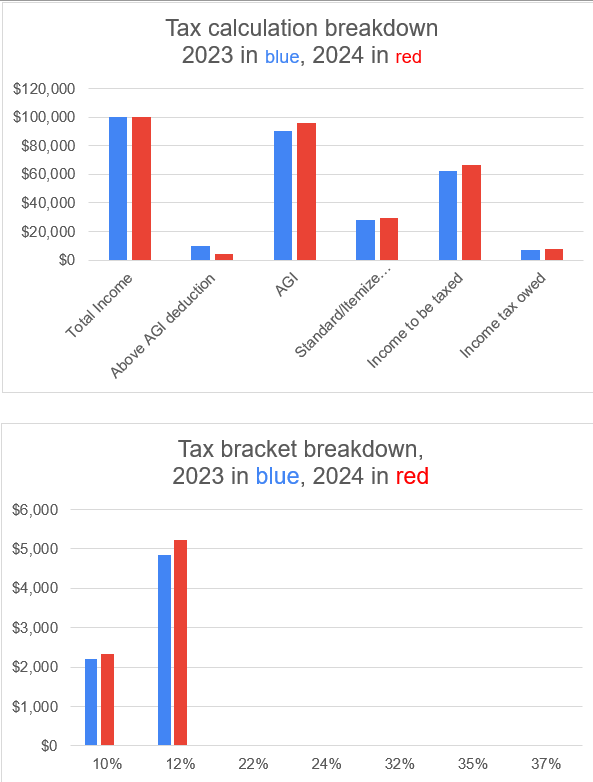

I started the Excel tax spreadsheet to estimate Roth conversion tax implications. After an unexpected tax bill due to the inability to undo a Roth conversion I decided to update the spreadsheet to calculate my income tax obligation before the end of the year. I learned a lot and saved a lot on taxes. The spreadsheet started to help with understanding marginal tax rates (rate on +$1) and effective rate (overall rate of taxes).

This spreadsheet could tell you putting extra money into your HSA, IRA will save you at the 12% rate or the 22% rate. Roth conversion will move you to new marginal rates, 12% tax might make financial sense, 22% not so much.

This spreadsheet will help you understand tax implications before the end of the year. This makes it easier to finish your taxes and not to have any unexpected tax bills. I hope these spreadsheets will also help you in you income tax preparation.