Description

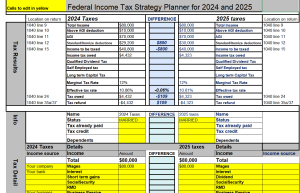

Tax Planner spreadsheet 2024 and 2025 , Self employment (Etsy 1099) tax planner, includes W2, ,business and capital gains

Original price was: $4.99.$1.99Current price is: $1.99.

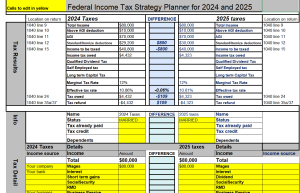

This spreadsheet compares 2024 taxes and 20245taxes side by side. The 2024 values can be entered on the left side and copied to the 2024 values on the right. Tax information includes income from W2, self employed 1099(Etsy), capital gains, and business tax. Tax information can be saved to plan for multiple years.

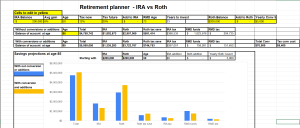

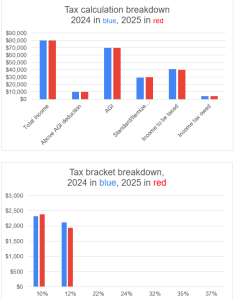

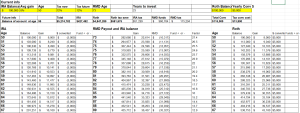

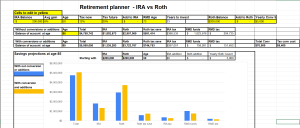

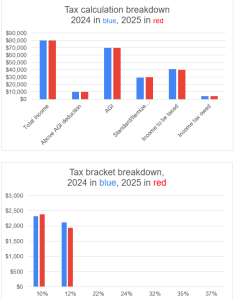

The Tax Planner spreadsheet will save all your tax document values and estimate your 2024 taxes before sending your documents to a tax preparer or entering into tax software. The spreadsheet can have strategies side by side to find ways to save on taxes. The spreadsheet shows how your taxes are calculated by showing the marginal rate (the next dollar) in the tax brackets. The spreadsheet has an above AGI deduction (HSA,IRA) area and shows that tax savings by using these deductions. The itemized deduction area can sum your deductions to see if you should take the standard deduction or itemize. There is a Roth Conversion calculator to see what the future value of the conversion and taxes saved by switching from IRA to Roth. The spreadsheet also can calculate the right amount to convert to keep you in the tax bracket you want to stay in.

Tax Planner spreadsheet 2024 and 2025 , Self employment (Etsy 1099) tax planner, includes W2, ,business and capital gains

| Excel Tax Planner | This spreadsheet compares 2023 taxes and 2024 taxes side by side. The 2023 values can be entered on the left side and copied to the 2024 values on the right. Tax information includes income from W2, self employed 1099(Etsy), capital gains, and business tax. Tax information can be saved to plan for multiple years. |

|---|---|

| Tax Spreadsheet | Tax spreadsheet planner. Calculate your taxes and view how they are calculated |

Reviews

There are no reviews yet.